HANOVER INSURANCE GROUP (THG)·Q4 2025 Earnings Summary

Hanover Insurance Posts Record EPS as Combined Ratio Hits 89%

February 4, 2026 · by Fintool AI Agent

The Hanover Insurance Group delivered a record fourth quarter, posting operating EPS of $5.79 — crushing consensus estimates by 15% and capping what management called "the highest annual operating return on equity in company history."

The combined ratio fell to 89.0%, marking only the second sub-90% quarter in recent years. Net investment income surged 25% to $125.8 million, while book value per share hit $100.90 — up 27% year-over-year.

Did Hanover Beat Earnings?

Yes — decisively on the bottom line, slight miss on premiums.

*Values retrieved from S&P Global

The EPS beat was driven by three factors: (1) excellent underwriting results with a current accident year combined ratio ex-cats of 88.6%, (2) net investment income up 24.9% YoY, and (3) favorable prior-year reserve development of $20.1 million.

The modest premium miss reflects disciplined underwriting rather than demand weakness — the company maintained strong retention (85.3% in Core Commercial) while pushing renewal price increases of 9.4% in Core Commercial and 9.2% in Personal Lines.

What Changed From Last Quarter?

The Q4 results built on an already strong 2025 with several notable improvements:

Improvements:

- Combined ratio improved 20bps sequentially (89.0% vs 91.1% in Q3)

- Net investment income jumped to $125.8M from $117.0M in Q3 (+7.5%)

- Book value accelerated: +5.1% QoQ vs +3.8% QoQ in Q3

- Personal Lines combined ratio dropped to 85.5% from 89.2% in Q3

Areas to Watch:

- Core Commercial combined ratio ticked up to 96.1% from 94.0% in Q4 2024, primarily due to higher catastrophe losses (4.8 pts vs 1.5 pts prior year)

- Specialty renewal price increases slowed to 6.4% from 8.3% in Q3, reflecting increased competition in larger property accounts

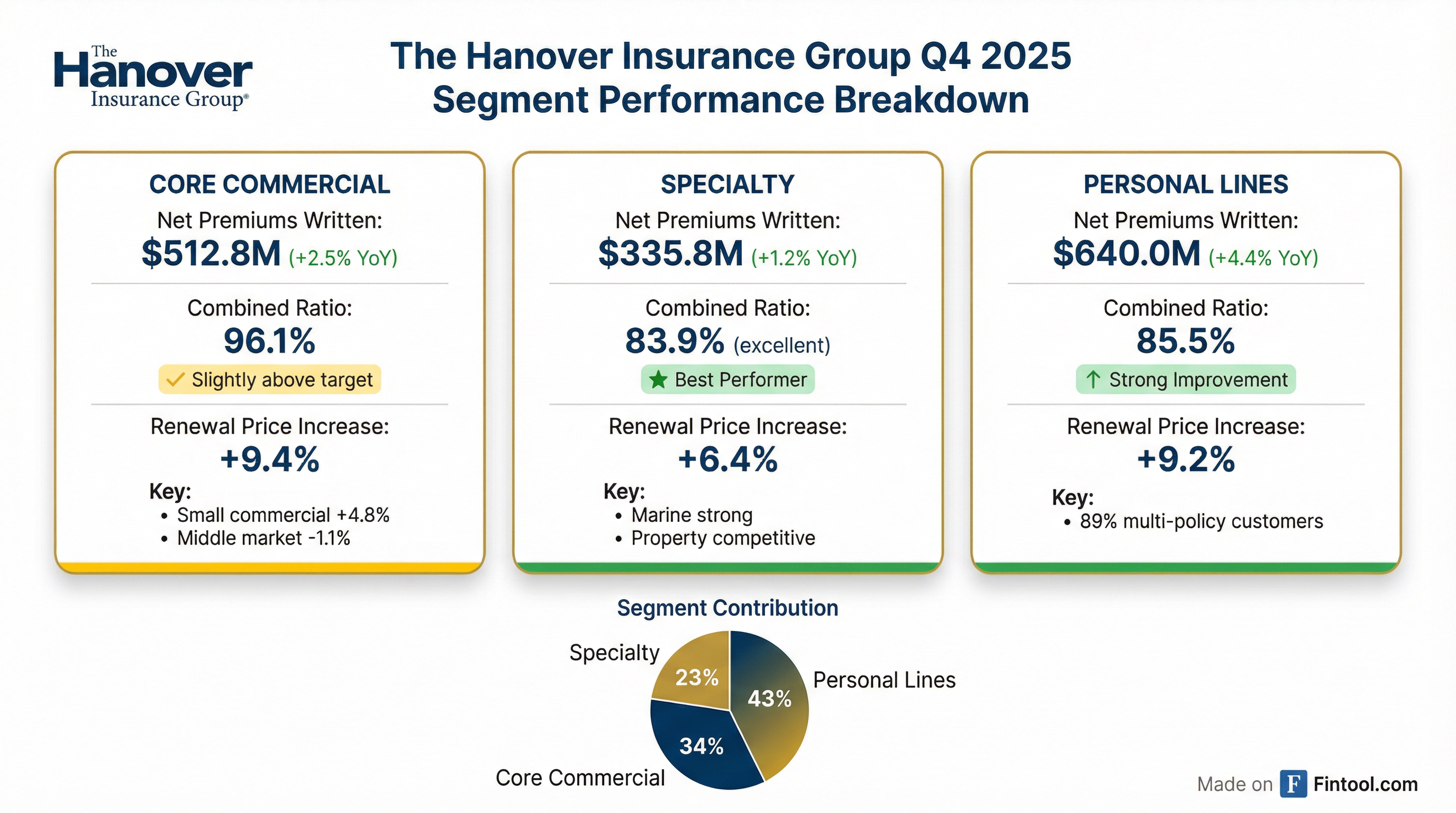

How Did Each Segment Perform?

Personal Lines — The Turnaround Story

Personal Lines delivered the most dramatic improvement, with operating income of $127.1 million versus just $101.1 million in Q4 2024 — a 26% increase.

The turnaround reflects earned pricing finally outpacing loss trends. Current accident year loss ratio ex-cats improved 80bps to 59.0%, driven by lower property claims frequency in both auto and homeowners.

Key strength: 89% of Personal Lines customers hold multiple policies, driving retention that supports pricing power. Management noted that common effective dates (both policies renewing on the same date) further protect against shopping behavior.

Geographic diversification: The company is focusing growth in 11 key states with compelling expansion opportunities. Premiums in these diversification states grew ~8% in Q4 versus 3% in all other states. This effort has reduced Midwest exposure by ~4 points since early 2023.

Specialty — Consistent Excellence

Specialty remains the crown jewel with a combined ratio of 83.9% and operating income of $82.1 million.

The sequential moderation in pricing and growth reflects management's disciplined approach to competition in larger-sized property markets. CEO John Roche noted the company is focusing on "smaller-sized accounts across most of our portfolio" where opportunities are more attractive. The segment benefits from an AI-powered submission triage system that's "delivering nicely" and expanding risk appetite in targeted areas.

Core Commercial — Higher Cat Load

Core Commercial posted operating income of $75.1 million with a combined ratio of 96.1% — above the company's target but explained by elevated Q4 catastrophe activity ($26.9M vs $8.4M prior year).

The underlying performance was strong — current accident year combined ratio ex-cats improved 2.4 points to 91.6%, with the expense ratio down 0.9 points to 34.2%.

Strategic initiative: The Workers' Compensation Advantage product is now live in 17 states, with a national rollout targeted by end of 2026. This makes it easier for agents to place new business and transition books of business to Hanover as smaller markets consolidate.

What Did Management Say?

CEO John Roche highlighted the company's strategic positioning:

"We achieved record annual operating return on equity of 20.1%, the highest in our history, and 23.1% in the fourth quarter... Our diversified and specialized product set and disciplined approach to managing profitability at the individual account level enable us to identify and capitalize on the most compelling opportunities."

CFO Jeffrey Farber emphasized balance sheet strength and capital returns:

"We increased net investment income by nearly 25% in the fourth quarter and 22% for the year... During the fourth quarter, we raised our quarterly dividend by 5.6% to $0.95 per share, marking our 21st consecutive annual increase. We also repurchased $130 million of shares over the course of the year."

Investment Income — A Major Tailwind

Net investment income surged 24.9% YoY to $125.8 million, a story that has been building for multiple quarters:

The yield improvement reflects portfolio repositioning efforts and higher reinvestment rates. The average pre-tax earned yield on fixed maturities reached 4.41% in Q4, up from 3.99% a year ago.

The investment portfolio totals $11.5 billion with 95% investment-grade fixed maturities. Net unrealized losses improved to just $149 million from $509 million a year ago.

Capital Allocation — Shareholder-Friendly

Management demonstrated balanced capital deployment in 2025:

- Dividends: $130.6 million paid in FY2025; quarterly rate increased to $0.95/share (+5.6%)

- Buybacks: $130 million repurchased (754,000 shares); additional $44 million in January 2026 — totaling $100 million over the last four months

- Remaining Capacity: ~$130 million under existing authorization. CFO Farber noted: "With growth being a little bit lower in the last 12 months and the earnings and profits being super strong, we're building a lot of capital... I suspect the stock buyback will continue to play a meaningful role."

- Statutory Surplus: $3.34 billion (+12% YoY), providing significant financial flexibility

How Did the Stock React?

The stock traded up modestly on the announcement:

The muted reaction likely reflects the strong results being partially expected after Q3's momentum. THG is up 15% from its 52-week low and trades at roughly 17x trailing operating earnings — reasonable for a specialty insurer delivering 20%+ ROE.

Full Year 2025 — Record Results

Catastrophe losses of $276.3 million (4.5 points) were significantly better than 2024's $375.9 million (6.4 points), contributing meaningfully to the combined ratio improvement.

Q&A Highlights — What Analysts Asked

The Q&A session surfaced several important themes:

On Auto Liability Reserves: Analyst Mike Phillips (Oppenheimer) asked about reserve activity. CFO Farber confirmed the company raised personal auto BI picks in Q4 and has been adding IBNR reserves for commercial auto across 2023-2025 accident years. CEO Roche emphasized: "I think we leave 2025 with the strongest balance sheet that we've ever had."

On Liability Severity Trends: Asked whether social inflation is stabilizing, CEO Roche offered a measured view:

"I think overall, what we're witnessing now is that the liability severity trends are presenting themselves in a pretty mature way... there's not too many severe injuries that don't include a lawyer and lawyer representation, and the courts are obviously in full gear. So I think there is a little bit of a leveling out in terms of the environment itself."

On Personal Lines Growth Outlook: COO Dick Lavey shared the company's North Star: "to be the best market in the IA channel for preferred accounts." He indicated mid-single-digit growth is the target as pricing normalizes, with policy-in-force (PIF) growth expected in 2026 after a modest decline in 2025.

On Middle Market Competition: Analyst Paul Newsome (Piper Sandler) asked whether large account competition is pushing into middle market. CEO Roche acknowledged some pressure on larger property schedules but noted liability pricing remains firm:

"There's parts of the middle market sector, particularly on the liability side, that are definitely on the front end of a firming market... the human services sector... has some real challenges in terms of market access, particularly in the professional liability, and the sexual abuse and molestation lines."

On E&S Demand: President of Specialty Bryan Salvatore confirmed strong submission flow continues: "We have not seen any abatement in the activity in our E&S book. It grew double digits throughout the year... The submission volume is quite high." The company benefits from positioning in middle-to-smaller E&S and having both retail and wholesale access channels.

On Q1 Catastrophes: Asked about winter storm Fern's impact, management confirmed it represented most of January's cat losses but there's "no reason to modify our first quarter cat estimate of 6.1%."

Key Risks and Considerations

Management highlighted several forward-looking uncertainties in their cautionary statements:

-

Catastrophe Volatility: While 2025 saw lower cat losses, the company remains exposed to hurricanes, severe winter weather, and wildfires. Modeling limitations exist for emerging climate patterns.

-

Social Inflation: Increased litigation, lawsuit abuse, and higher settlement costs continue to pressure casualty lines, particularly in commercial auto and workers' compensation.

-

Rate Adequacy in Core Commercial: The 96.1% combined ratio in Q4 suggests Core Commercial remains a work-in-progress. Commercial auto liability and workers' comp saw "prudently increased loss selections."

-

Competition in Specialty: Larger property accounts face intensifying competition, limiting growth opportunities in that profitable segment.

What Did Management Guide for 2026?

Management provided specific full-year 2026 expectations in the earnings presentation:

Key takeaways from guidance:

- Continued underwriting improvement: The 88-89% ex-cat combined ratio target implies further progress toward industry-leading profitability

- Expense discipline: The 30.3% expense ratio target would be an 80bp improvement from FY 2025's 31.1%. Management noted this will be the last year providing specific expense ratio guidance — future guidance will focus on combined ratio overall.

- CAT assumption: The 6.5% catastrophe load is notably higher than 2025's 4.5% actual, reflecting prudent planning after a benign weather year

- Investment income tailwind: Mid- to upper-single digit growth on top of 2025's 22% surge suggests continued portfolio optimization

Looking Ahead

The Hanover enters 2026 with significant momentum:

- Record operating ROE of 20.1% provides a strong baseline

- Investment income tailwind should continue as higher-yielding assets roll on

- Personal Lines turnaround appears durable with earned pricing exceeding loss trends

- Balance sheet strength ($3.34B statutory surplus) supports continued capital returns

- Policy-in-force growth expected to resume in 2026 after modest 2025 decline

The company's investment portfolio remains high-quality with 95% investment-grade securities, A+ weighted average credit quality, and 4.3-year duration.

Related: THG Company Profile · Q4 2025 Earnings Transcript · Q3 2025 Earnings